UPDATE

Welcome to the first edition of the World TradeWinds eZine for 2017. This issue features initiatives on trade and investment with Vietnam, as well a special follow up article on the controversial South China Sea island expansion. Additional periodicals from Ayse's Corner, Tommy's Taglines and Trade Promotion are enclosed, as well as a special article from MBITA member, John Keevan-Lynch of Provident Traders, espousing his expertise on credit insurance, and a friendly word from long time member, Jack Ybarra of Transmetrics.

President

Tony Livoti

MBITA

Vice President

Shay Adams

AIM Medical Sales

Members

Dr. Edward Valeau

Els Group LLC

Hartnell College

President Emeritus

Marcelo Siero

IdeasSiero

Jim Faith

Jim Faith & Associates

For this reason membership in MBITA is vital. MBITA hosts several events throughout the year which allow small businesses to meet and network with potential clients or business partners. All this is available in the Monterey Peninsula and the Silicon Valley. While Transmetrics, a local small engineering business, is not currently marketing its services abroad, it has received invitations from foreign companies seeking local partners for work within the United States.

As we move further into a globalize economy, these contacts become ever more important. During the past ten years, Transmetrics has formed several business ventures with its foreign counterparts for work in California. Among the countries represented by the firms were Taiwan, Italy, France, Spain, Japan, China and Canada.

If the incoming administration stands by its stated goals, public private partnerships will be encouraged for public infrastructure work. Already large international firms have established offices in California and will be required to include small companies in their proposals. Among the international firms already in California are the Spanish companies of Sener, Dragados, OHL, and ACS. In addition, the California Consortium comprised of Mitsubishi, Kawasaki, Hitachi and Sumitomo are present in the state. Italy is represented by Salini Impregilo and Geodata, S.p.A.

An exciting new era for small businesses is beginning and participation with MBITA is an important first step. Changes which will bring new opportunities for small businesses are in the horizon. The time to prepare for the forthcoming change is now. However, before entering into a joint venture for work inside or outside the country, seek the advise from an experienced international lawyer. This region has excellent international legal advisers, but there are organizations available to assist you such as MBITA who is in touch with local, State and Federal resources.

In addition to the above-mentioned activities, VIDG is also cooperating with various organizations both in Vietnam and in the US to bring Vietnamese professionals/graduated students to participate in Internship programs under the Cultural Exchange Program of the US State Department, especially in IT, Agricultural and Hospitality fields.

In 2015, California was the top state exporter to Vietnam with over $1.2 billion, making up 17.7% of all U.S. exports to Vietnam in goods. California exports to Vietnam have more than doubled since 2007 and have increased by 3.5% from 2014 to 2015. Vietnam is California's 26th largest export destination. (California Chamber of Commerce)

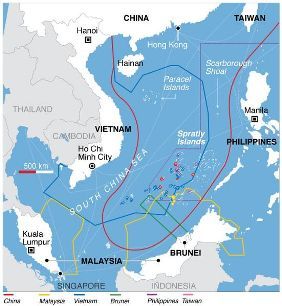

South China Sea Arbitration Award Update

by MBITA Member James P. Rowles, Esq.

We described in a previous article the holdings in the South China Sea Arbitration Award of July 12, 2016, which upheld the Philippines' claims against China regarding China's activities in the South China Sea including island-building on certain reefs.

James Rowles, Esq.

International Legal and Management Consulting

P.O. Box 7153

Menlo Park, CA 94026

Tel. (650) 466 0111

Email: jrowles@pacbell.net

More info

Ayse's Corner

Ayse's Corner is a feature column of the World TradeWinds eZine'. Ayse Oge is a published author and global trade marketing expert and author of Emerging Markets.

The "Asian Century" Has Arrived

"The 21st century will be a contest for supremacy in the Pacific because that is where the growth will be." - Lee Kuan Yew, Former Prime Minister of Singapore

The Asia-Pacific is now the most dynamic economy in the world. Boasting almost half of the world's population, it also accounts for around half of all economic output. Northeast Asia (including China, Japan, South Korea and Taiwan) has enjoyed significant levels of economic growth since the latter part of the 20th century with booming export sectors and emerging middle-class consumer bases.

Here are the facts behind the concept of this "Asian Century" - meaning that the world's political and economic center of gravity is shifting to Asia in the 21st century:

- Rising trade - Asia's share of global merchandise trade grew to 32% in 2014, with its exports growing at three times the rate as the rest of the world over the past few decades. Now, China is the largest trading nation in the world in terms of imports and exports, since overtaking the U.S. in 2013. Free trade agreements are also on the rise, since the 21st century began. Asia's concluded FTAs jumped from three to 76. The Asian-China Free Trade is the largest free trade area in terms of coverage, with over 1.9 billion people in it. Such a fast-growing regional trade and investment environment will surely encourage young Asians to be entrepreneurial and pursue closer cooperation with one another.

- Hub of globalization - Asia is where most global product is made, an intricate network that takes software and design from the U.S., microchips from Japan, and screen technology from South Korea, and assembles them into iPads in a factory produced in Southern China. Given that nearly 90 percent of intercontinental commerce travels by ship in Asian seas, Asia's seas have become the symbol of globalization. The container ships carry as many as 7,000 containers and travel the long sea-lanes west from Asia toward Europe and east toward the U.S.

- Rising middle class - Asia's emerging middle class is predicted by the OECD to grow from 500 million in 2009 to 3 billion by 2030, which will bring far-reaching economic change, creating new market opportunities for both multi-nationals and small and medium-sized enterprises in the U.S. The demand for consumer durables has increased in the region, with China becoming the world's largest market for automobiles and mobile phones. But there is still a high demand of luxury goods, and technological and educational products as the purchasing power of the Asian middle income class catches up to that in more advanced countries. The middle class is already showing itself in the travel market, with cruise ship passenger numbers up by 39% in Asia, compared to a 4% growth in the rest of the world.

However, despite the existing huge growth potential, Asia is facing some shortcomings in achieving a more comprehensive and sustainable development. Among the challenges Asia has is a lack of a universal image, which involves diverse political systems, economic development, social cultures and languages. As China, India and Indonesia enjoy rapid economic growth, other Asian countries still suffer extreme poverty. Asia's second-largest economy, Japan, has been battling with slow growth for years, and a widening income gap is contributing to this non-inclusive economic development.

As young Asians are growing up with a booming intra-regional trade and entrepreneurs are making inroads into the Asian economy, we need to get on board the "Asian Century" train and focus on building solid trade and investment relations to bring together the U.S. and Asia, the two most dynamic and innovative regions of the world.

Ayse Oge is President of Ultimate Trade, International Trade Consulting, Speaking and Training. Ayse Oge is International Trade Consultant, Speaker and Trainer. She has served as an instructor for SCORE (Service Corps of Retired Executives) with the same goal as her focus. Ms. Oge has authored numerous articles and several publications including books, World Smart Veterans: From War to International Trade, Go Global to Win and World Wise Children. Ms. Oge's list of certificates, honors and awards for her leadership and service includes The Business Education State Advisory Committee.

MBITA's trade finance column features articles from the experts in the field of EXPORT FINANCING.

Prior-To-Export Progress Payment Credit Insurance

Without the L/C, payment is not guaranteed and financing the manufacturing costs is more difficult.

However, some banks are prepared to finance the manufacturing costs of overseas sales by using the Export-Import Bank of the United States' (Exim) Working Capital Guarantee (WCG) support, provided the buyer is credit-insured against non-payment to the bank's satisfaction.

Credit insurance is easy enough to arrange, if the buyer is creditworthy and payment terms are 100% open account after export.

But what if the exporter negotiates several prior-to-export progress payments and one post-export final payment in order to reduce its non-payment exposure and its financing costs? Not so easy.

I recently approached two large well-established private-sector credit insurers regarding the prior-to-export progress payments. They could only offer a 'Pre-shipment' policy (also called 'Contract Frustration') that insured against specific political risks that prevented the export or import of the insured product, such as war, expropriation, cancellation of an import or export license (ex.: President Carter cancelling export licenses to Russia). And, on a case by case basis, they were willing to cover the buyer's bankruptcy.

But, the private sector insurers' pre-shipment policies did not cover protracted default (90+ days slow pay) for the prior-to-export progress payments, the lack of which would make any Exim WCG bank unable to finance the prior-to-export progress payments.

I also approached Exim. It turned out that Exim could insure the prior-to-export progress payments against non-payment due to commercial or political reasons, including the buyer's 'protracted default'. Exim also covered the buyer's 'non-acceptance' of the equipment before and after it was exported, provided the non-acceptance was not due to a product dispute.

Among the documents required for a progress payment claim, Exim sometimes accepts 3rd party verification (SGS or BV) that the billed work was completed per contract specifications, rather than requiring the exporter persuade the buyer to sign/accept the progress payment invoice.

These 3rd party verification documents also help reduce the possibility that a buyer might allege a product dispute as the reason for its non-payment of a post-export final payment, a cause of buyer non-payment excluded from credit insurance coverage. Why? Credit insurers slice a transaction into two pieces: the commercial piece, i.e., blue widgets vs. green widgets and the financial side; the buyer's ability pay. If a buyer does not pay due to an alleged product dispute ('I ordered blue widgets and got green widgets!') no credit insurer will pay a claim because (1) they don't know the difference between blue and green widgets (and don't want to know) and (2) they are only insuring the buyer's ability to pay.

Moral of the Story: credit insurance lacks an L/C's irrevocability (see Note 1 below). However, Exim's prior-to-export progress payment protection gives a US exporter-manufacturer a viable alternative with which to reduce payment risk, finance the prior-to-export inventory and close the sale.

Notes:

1) Credit insurance policies lack an L/C's non-cancellable irrevocability.

a) No credit insurer covers a buyer's 'arbitrary' cancellation of the purchase order (considered a 'know your buyer' risk that only the exporter can gauge and must bear) and

b) Even if the insurance policy is 'non-cancellable', the policy's 'Agreements of the Insured' prohibit the exporter from continuing to work for (or ship to) a buyer if the buyer is known to be in financial difficulties or has not paid earlier progress payments.

2) Exim defines insurable progress payments as payments for work performed and/or costs incurred and invoiced. Advance payments and milestone payments that are payable at a pre-determined time, with no requirement that a specified amount of work be performed, are not insurable.

T. John Keevan-Lynch is President of Provident Traders, Inc., a Northern California based export finance consultancy and licensed export credit insurance broker with more than 35 years experience with Exim.

©2017 Provident Traders, Inc.. All rights reserved.

Contact:

T. John Keevan-Lynch

President

Provident Traders, Inc.

Tel. (707) 895-9353

Email John Keevan-Lynch

Web: www.providenttraders.com

EXIM Bank Releases its FY 2016 Annual Report

Washington, DC - On Jan. 4th the Export-Import Bank of the United States (EXIM Bank) released its Fiscal Year 2016 Annual Report highlighting its support of more than $8 billion in U.S. exports and an estimated 52,000 U.S. jobs.

The Bank also announced it has transferred $284 million in deficit-reducing receipts to the U.S. Treasury's General Fund for fiscal year 2016.

EXIM Bank is a self-sustaining federal agency and operates at no cost to the taxpayers. Since 2009, EXIM has sent nearly $3.8 billion of surplus to the U.S. Treasury for deficit reduction. In the last decade, EXIM has supported more than 1.7 million jobs in all 50 states.

"The Bank is proud of its 2016 performance in leveling the playing field for U.S. exporters who must compete with foreign state-backed companies around the globe for important sales," said Fred P. Hochberg, EXIM chairman and president. "It is now more crucial than ever to leverage EXIM's capabilities to stimulate U.S. exports abroad and bolster U.S. jobs at home."

Among the highlights in the 2016 Annual Report are the following:

- EXIM authorized $5 billion supported $8 billion in exports at no cost to American taxpayers.

- EXIM supported 52,000 American jobs.

- Small business authorizations continued to represent nearly 90 percent of all EXIM authorizations.

- EXIM sent $284 million to the U.S. Treasury for debt reduction.

- EXIM Bank had a default rate of 0.266 percent as of September 30, 2016

Small business exporters can learn about how Ex-Im Bank products can empower them to increase foreign sales by clicking here. For more information about EXIM, visit www.exim.gov.

This press release was published by Exim Bank on January 4th, 2017.

View source press release.

Tips for Your Business Strategy: HS Codes

This article provides best practices and an overview of how to determine the HS and Schedule B code for a product.

Determining the HS and Schedule B codes for your products can be complicated, depending on how many products you have and how diverse your product line is. The strategies below can help you simplify the product classification process.

Working with Your Suppliers

If you need to classify a large number of products, asking your suppliers to provide HS and/or Schedule B numbers could save you time. If you resell products that you purchased wholesale, your suppliers may have classified them already, especially if those suppliers have exported or imported them in the past. If you're reselling products imported from an international supplier, then the shipping documentation probably lists the HS number and may contain the full Schedule B number. Keep in mind that modifying the product may change its classification.

Always remember, though, that you, the exporter, are responsible for correct reporting to the U.S. government, regardless of any classification your supplier may suggest. This is an important consideration when determining whether simply to accept your supplier's suggested Schedule B numbers.

Some additional suggestions for using your supplier's HS codes include:

- Use them as a guide to direct you to the approximate location of the code in the Schedule B book, and then use your own analysis to determine which code you will use.

- Conduct your own product classification, and then use the supplier's code as a way to double-check your work.

Sellers Top

If your company has thousands of items in its inventory, you may not need to classify all of them, especially if you're just beginning the classification process. Remember, you only need to assign Schedule B codes to items that will actually be exported. If you plan to sell only some, rather than all, of your items to international clients, or if you think there is no market outside of the United States for certain products, then classify only the ones you plan to export.

Start by classifying your top-selling products. Use these criteria to determine which products to code first:

- Products with a history of international sales, if any

- Top-selling products overall

- Products you have determined to be the top prospects for international sales

- Items in sales materials (e.g., catalogs, your website, etc.) that can be accessed by international customers

Grouping

Another time-saving strategy for classifying large numbers of products is to group them by product type. As noted earlier, the Schedule B book is divided into chapters, with like products found in the same chapter. For example, Chapter 65 addresses headgear. Grouping all your hats, helmets, and headbands together and classifying them simultaneously according to the information in Chapter 65 would be much easier than constantly jumping from product to product in your portfolio. By focusing on one chapter at a time, you will become much more familiar with the classification codes in the chapter so you can quickly identify the correct codes for your products.

Worldwide Sales Permission

If you sell products that you didn't manufacture, be sure that your distribution agreements allow you to resell the products internationally. Some manufacturers don't want their products sold internationally because they are concerned about issues like liability and warranty coverage. If an item you offer domestically can't be sold internationally, don't spend time classifying it.

Pricing

In general, you'll want to select products for cross-border eCommerce that deliver the margins you seek after subtracting the costs of getting the product to the buyer. At the same time, you need to be conscious of what competitors are charging for similar products. You can easily get this information the same way buyers do: by comparing products and prices online.

These days, on- and offline exporters must carefully monitor the prices of their products and the strong dollar. For example, some buyers may have to pay 25 percent more for your product this year than last. Depending on the product and the market, little profit may be possible from the sale, but you can take some practical, common-sense actions to help manage the strong dollar's effect on your pricing and profit.

This article was published by Export.gov on October 24, 2016.

View source article.

##########

The National Export Strategy is available at

http://export.gov.

##########

International Trade Administration

The International Trade Administration (ITA) is the premier resource for American companies competing in the global marketplace. ITA has 2,100 employees assisting U.S. exporters in more than 100 U.S. cities and 72 countries worldwide. For more information on ITA visit www.trade.gov

United States Department of Commerce

Office of Public Affairs - Tel. 202-482-4883

##########

Must See Video on Global Trade

Click HERE to see the 'Making Hay' video by Dan Gardner of Trade Facilitators, Inc. This multi-industry webinar is a 'must see' for global trade students and practitioners of all levels and World TradeWinds considers it to be one of the most concise and informative webinars on the history, present state and the future of the Global Trade industry there is available today.

Sponsors, Partners, & Affiliates