UPDATE

This time last year the global economy was much less sure of itself as we battled the ‘great recession’. Steady growth and investment in the clean-tech industry and increased exports are painting a brighter future for 2011.

This issue features NEI updates and details on two MBITA/TradePort conferences on agro-technology exports and the European marketplace.

The staff of MBITA and TradePort wish you all a safe, healthy and prosperous New Year as we move further into the exciting, and sometimes daunting, 21st Century.

President

Tony Livoti

MBITA

Vice President

Shay Adams

AIM Medical Sales

Members

Dr. Edward Valeau

Els Group LLC

Hartnell College

President Emeritus

Marcelo Siero

IdeasSiero

Jim Faith

Trade Export

Finance Online

(TEFO)

Cristina Polesel

MBITA

General Manager

This newsletter has been

created by MBITA's editor

Cristina Polesel

cristina@mbita.org

New MBITA Corporate Sponsor

Project 17 is a Small Business Administration-funded project to provide start-up, commercialization and export assistance to advanced ag-tech companies in the Santa Cruz, Monterey and San Benito tri-county region with the goal of making the region the place to be if a company is developing and marketing technology solutions into the ag industry.

MBITA is Project 17’s export-expertise partner. Through the partnership with MBITA, Project 17 will help client companies develop new markets for exports.

“The first thing we are doing is organizing an association,” said BBS Partner Susan Barich. “We are also in the discussion phase of creating a venture or angel fund for ag-tech companies. MBITA’s participation is vital in helping companies develop export capability.”

The association will bring ag-tech companies together for purposes of networking, communications, standards setting, and group marketing. It will also provide knowledge exchange between the ag-tech companies and the large producers and shippers.

The fund will allow companies that need seed funding to be able to get into operation and deliver on contracts and take more well established companies to the next level of growing their businesses.

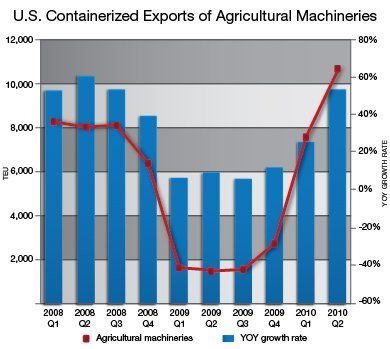

Top Source Countries Identified for U.S. Containerized Imports

By MBITA Member PIERS

MBITA Member PIERS forecasts moderate growth rate in 2011

Request more information!

Call today!

800.952.3839

PIERS | 2 Penn Plaza East, 12th Floor, Newark, NJ 07105

800-952-3839 or 973-776-660 | info@piers.com | www.piers.com

UBM Global Trade |2 Penn Plaza East, 12th Floor, Newark, NJ 07105 | USA UBM Global Trade is the leading provider of proprietary data, news, business intelligence and analytical content supporting commercial maritime, rail, trucking, warehousing and logistics industries worldwide.

The Importance of exports to create new, high paying jobs, especially from our small business sectors, is very important to our economic recovery. World TradeWinds has established a new section that will keep us up to date on all aspects of the NEI and our progress to meet the President’s goal of doubling exports in the next five years…

President Obama’s National Export Initiative (NEI) calls for us to double exports in the next five years to help create 2 million new good paying jobs through exports. Big business is producing more with less so that leaves small to mid-sized business as the engine of export growth for job creation.

Through the NEI, the government is now taking steps to open up new markets and level the playing field for American workers. The President has directed the federal government to use every available federal resource in support of this effort:

- Create an Export Promotion Cabinet made up of the Departments of State, Treasury, Commerce, Agriculture, Commerce, and other federal agencies responsible for exports.

- Re-establish the President’s Export Council, the principal private sector advisory committee on international trade.

- Ramp up Export-Import Bank trade financing for businesses, especially small and medium businesses that want to export their goods but just need a boost.

- Create a Senior Visitor Business Liaison in every one of our embassies to proactively look for export opportunities and provide advice to American companies.

- Employ new technologies and pursue public-private partnerships so that exporters can draw from the global shipping knowledge and resources of companies like FedEx, UPS and the US Postal Service.

- Enforce our current trade agreements and strengthen our existing relationships by removing barriers that hamper U.S. companies to be competitive in the global marketplace.

- SBA's Export Working Capital loan guarantee program increased limits went from $2MM to $5.0MM.

AS AMERICA PUSHES FOR GROWTH, WILL YOUR BUSINESS BE LEFT BEHIND?

Based on primary data gathered by our own staff reporters at every major U.S. port, PIERS intelligence is the most timely and comprehensive information available on trade through U.S., Mexican, Latin American, and Asian ports. Our global trade intelligence can help identify emerging economic trends, facilitating forecasting and giving the insight necessary for you to identify suppliers, customers, and competitors worldwide. Gain details about trading parties, market share, commodities, TEUs, and more at piers.com.

Agriculture and the Green Revolution

3rd Annual Green Trade Network Summit - Salinas, CA

Dec. 1, 2010

The 3rd Annual Green Trade Network Summit was held on December 1, 2010 in the ‘salad bowl’ of the world, Salinas, California.

The conference entitled ‘Agriculture and the Green Revolution’, provided a forum to facilitate interaction and information exchange among research scientists, producers, agro-technology providers, equipment manufacturers, service providers, agronomic consultants, software developers, educators, government personnel and policymakers, all addressing the ‘greening’ of one of American’s top industries.

Susan Barich of Project 17 explains the SBA grant funded program to promote Central Coast Agro-technology.

An additional objective of this conference was to demonstrate how ‘Green’ agricultural products, services and technologies can be exported to create jobs here and now in the U.S. Presentations on trade finance, global marketing, logistics and government incentives for export to the foreign marketplace will be presented through panels and invited presenters.

The event was sponsored by Project 17 - Monterey Bay, whose mission is to support the growth of the agricultural industry and technologies that advance higher-paying agricultural jobs, national food security, food and agricultural-technology exports, and investment in agriculture and advanced agricultural technologies in the tri-county region of the Monterey Bay Area, including Monterey, San Benito and Santa Cruz Counties.

To view the presentation slides visit the event agenda at http://www.mbita.org/greentradenetwork/agenda2010.html

Please contact the MBITA office at 831-334-2218 or email at tlivoti@mbita.org for further details.

MBITA EVENT

As our global marketplace slowly recovers from the global economic crisis, Europe and the U.S. stand strong to further develop their long-standing friendship with bilateral trade and investment opportunities that will hopefully usher us into an unprecedented age of prosperity.

In particular, President Obama’s National Export Initiative (NEI) challenge to double U.S. exports in the next five years has presented Europe with the advantage of importing U.S. products, services and technologies into the EU.

This seminar/luncheon featured an array of experts discussing taxes, incentives, support services and opportunities that American companies can now utilize to enter the EU marketplace.

Ayse's Corner

Ayse's Corner is a feature column of the World TradeWinds eZine'. Ayse Oge is a published author and global trade marketing expert and author of Emerging Markets.

Africa is the Next Emerging Market

Trade Boosts Sub-Saharan Economy

by Ayse Oge

In its latest regional forecast, The International Monetary Fund noted that Sub-Saharan Africa’s accelerating economic growth is expected to be broad in 2011. In the IMF’s October 2010 report it was revealed that the growth of the Sub-Saharan region -- which encompasses 47 countries excluding North Africa -- would be 5% this year. The IMF also predicted a 5.5% growth next year. The organization attributed the Sub-Saharan growth mainly to trade with China, as well as other countries in developing sections of Asia and Latin America along with their high levels of reserved and low inflation.

China’s share in Sub-Saharan Africa’s total exports and imports exceeded that between China and most other regions in the world. Over the last 8 to 10 years, China heavily invested in trading oil and mineral in the region, particularly with South Africa, the continent’s largest economy. China also undertook investment projects to improve the infrastructure in terms of dams, bridges and roads. Abebe Selassie, Regional Studies Division Chief in the IMF’s Africa department, said: "The reason why China is interested in Africa is not just for the minerals and oil but because of its high growth."

Europe and the U.S. remain the region’s dominant trading partners. The U.S. is also heavily invested on the continent, at a level that IMF officials say is on par with China. Africa has become an attractive export destination for major U.S. corporations, such as Coca-Cola, when they experienced stagnant sales in North America. As CEO of Coke, Muhtar Kent said: "We will rely on some of poorest nations to generate the 7 to 9 percent earnings growth we promised to our investors." That means from the dukas of Nairobi to the “tuck shops” of Johannesburg, Africa’s mom-and-pop stores are main fronts in Coke’s growth plan, not only for the flagship soda but also for the company’s huge stable of waters, juices and other soft drinks. Coke has become the continent’s largest employer, with 65,000 employees and 160 plants. The current presence and the significance of Coke’s business in Africa are far greater than in India and China.

Here are some facts about Africa for U.S. investors and exporters:

- After China and India, Africa is seen as the next emerging billion-person market.

- The continent has large niches of consumer spending power.

- Tourism and telecommunications along with natural resources are hot industries for investors.

Overall trade will continue to be the main driver of Africa’s growth in the future. But the other essential drivers such as political stability and the business climate, including a prudent exploitation of natural resources and the quality of economic management, are also crucial for Sub-Saharan growth in this century.

Ayse Oge is a SCORE counselor and instructor. She is President of Ultimate Trade, International Trade Consulting, Speaking and Training. She can be reached at oge@earthlink.net

USA and India...

A 'win win'

in Trade Relations

By Veritrade Ltd.

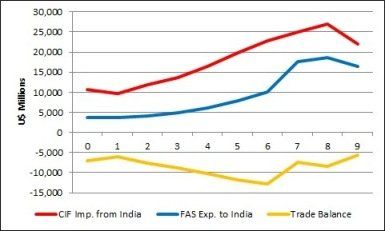

MBITA’s new Corporate Sponsor, Veritrade Ltd, has compiled some interesting statistics on bilateral trade between the U.S. and India in the past ten years and demonstrates again why India is such an important trading partner for American companies.

In the past 10 years bilateral trade between USA and India has grown by 169% totaling $38.5 billion USD in 2010. However, the U.S. trade balance with India has been negative in the past 10 years.

In spite of this trade imbalance with India exports from the U.S. to India have increased almost 350% since 2000 making India the 17th largest export market for US products and representing 1.6% of the total of all American exports.

USA Trade Balance with India

- US exports are led by non-industrial diamonds, gold unwrought or bars, civilian aircrafts, heavy machinery, boilers and mechanical appliances, electrical machinery, equipment/parts and fertilizers all representing 55.5% of total exports to India.

- Between 2000 and 2009 U.S. imports from India have grown by 107% with pharmaceutical imports alone increasing from $5.9 million in 2000 to $1.7 billion reflecting over a 28,000% increase.

- Other extraordinary import growth from India included organic chemicals +368%, iron made articles +340%, machinery and mechanical appliances +428% and electrical machines (sound equip., TV sets, etc.) + 412%.

- US imports from India are still being led by non-industrial diamonds, jewelry, textile garments which together account for approximately 40% of the total US imports from India.

Veritrade is a new corporate sponsor for

MBITA and TradePort.org

If you want to find similar bilateral trade statistics regarding India or other countries to determine the best markets for U.S. bilateral trade please login to:

Web site: www.veritrade-analytic.com using “mbita” as username and password.

User:mbita

Password:mbita

Sponsors, Partners, & Affiliates