UPDATE

In this issue we have the latest information on the new 'single window' revolution that is occurring in global trade logistics from Don Lewis, MBITA contributor, and the 'Streamlining Global Trade' TradePort.org event held at Pillsbury Law last July. We welcome Dan Gardner of World Trade Facilitators, Inc. as a new MBITA member who brings a world of global trade logistics experience to our organization, plus, some great updates in our trade finance section and a very interesting article in 'Ayse's Corner on the wine industry. Enjoy.

President

Tony Livoti

MBITA

Vice President

Shay Adams

AIM Medical Sales

Members

Dr. Edward Valeau

Els Group LLC

Hartnell College

President Emeritus

Marcelo Siero

IdeasSiero

Jim Faith

Jim Faith & Associates

Cristina Polesel

MBITA

General Manager

This newsletter has been created by MBITA's editor

Cristina Polesel

cristina@mbita.org

MBITA New Member Trade Facilitators, Inc.

Dawn of the U.S. Single Window: ACE and Beyond

by MBITA associate Donald Lewis

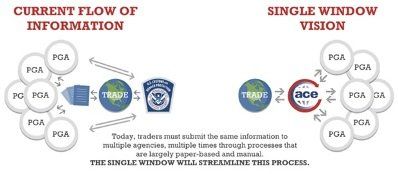

The Single Window is Coming! Traders Prepare! The U.S. Single Window will fully launch by the end of 2016 completely transforming the face of international trade by ushering in a new era of Global Electronic Trade. Single Window development has involved decades of preparatory work by the U.S. and IGOs, including UNECE, UN/CEFACT, the World Customs Organization (WCO) and the WTO.

The "Single Window" has been defined as:

A facility that allows parties involved in trade and transport to lodge standardized information and documents with a single entry point to fulfill all import, export, and transit-related regulatory requirements. If information is electronic then individual data elements should only be submitted once.

The two main drivers behind the deployment of the U.S. Single Window have been the adoption of the Trade Facilitation Agreement (TFA) at the WTO Bali Ministerial in December 2013 and President Obama's related Executive Order on Streamlining the Export/Import Process for America's Businesses issued on February 19, 2014.

The U.S. Single Window is called ACE (Automated Commercial Environment). ACE will provide the Trade with the ability to submit all required information by means of a single, electronic transmission, with the relevant trade data being distributed to the appropriate federal agencies for customs clearance and regulatory compliance purposes. ACE is managed by U.S. Customs and Border Protection (CBP).

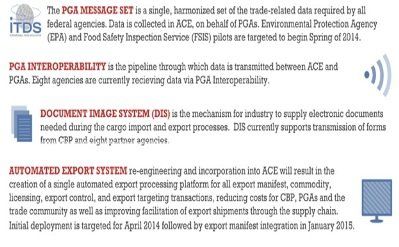

The four principal components of the ACE (and related ITDS) system are:

(1) PGA Message Set; (2) PGA Interoperability; (3) Document Imaging System; and (4) Automated Export System. There are two primary methods for Trade interaction with ACE: (1) filing transactions via the Electronic Data Interchange (EDI) interface, viz., the Automated Broker Interface (ABI); and (2) use of the ACE Secure Web Portal for B2G communications, certain filings and to run reports.

ACE presents significant benefits for SMEs and global supply chains in the form of substantial transaction and compliance cost savings. SMEs should be able to more easily integrate into global supply chains.

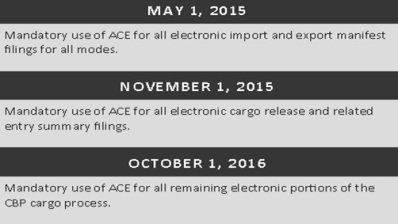

There are important looming USG mandatory deadlines for the Trade to comply with and use the ACE system.

ACE is an impressive milestone in trade facilitation and global e-commerce, but is only part of the picture. Unsettled policy areas for the U.S. include: (1) subnational Single Window portals; (2) integrated B2G/B2B Single Windows (e.g., in Korea and Singapore); (3) international interoperability of U.S. and other countries' Single Windows; and (4) internet vs. EDI-based platforms.

For further information about ACE:

see http://www.cbp.gov/trade/ace

Donald Lewis

International Trade and the 'Single Window' Chinese/USA Law Consultant

Tel. (408) 705-0676

email: lewlaw24@gmail.com

Brand Monterey Bay Visits Jinan, China on Solar Highway Project

By Tony Livoti, MBITA/TradePort President

Brand Monterey Bay (BMB) visited Jinan, China this past August after hosting a Shandong delegation in the Monterey Bay last spring. Jinan, China, the third richest province in China, is the capital of Shandong and is called the Spring City in China because of the numerous springs situated in the center and around the downtown area of Jinan and where city dwellers come on the weekends to enjoy and play with the fresh and clean spring water.

Jinan is a major commerce center for China close to one of the world's largest ports at Qingdao, about 40 kilometers from Jinan. More than 10 multi-national corporations, including Panasonic, Matsushita, Siemens, Pepsi-Cola and Volvo, have set up successful joint ventures in Jinan. At present, the city has more than 2,500 foreign enterprises in forms of joint ventures, co-operative businesses or foreign-funded enterprises, utilizing about US$ 3 billion in foreign funds.

During the trade mission, Tony Livoti, President of BMB and MBITA/TradePort, conducted a high level meeting with the chairman of Shandong High Speed Rail where subsequently a MOU was signed and agreed upon to work jointly on a project to build solar roadway and rail models in Jinan and the Monterey Bay.

After the meeting Mr. Livoti was the first foreigner to visit the newly completed and first solar highway model in China that was built by Shandong High Speed Rail and is a good model for the Monterey Bay to follow.

"These solar highways and railways models can be a great springboard for renewable energy generation that can be adopted as a clean source of solar energy that would be located in the unused, 'right-of-way' land adjacent to the millions of miles of roadways and railways scattered throughout China and the U.S.", states Tony Livoti.

There was some time left for some sightseeing after a busy schedule of meetings with Shandong Ocean Investment Co. where discussions were held on business linkages to Monterey Bay's leading marine science community, as well as meetings with the China Council for the Promotion of International Trade (CCPIT) in Shandong- regarding the development of a sub-national, 'single window' trade logistic service for one-time eDoc entries that will streamline global trade logistics for importing and exporting and would become operational through TradePort.org and its counterpart in Shandong.

Streamlining Global Logistics Event Draws Attention to the Future of Global Trade

MBITA/TradePort in partnership with Global 4PL conducted an event this past July at Pillsbury Law in Palo Alto, Ca. entitled 'Streamlining Global Trade'.

The conference featured experienced panelists and new companies with innovative technologies on the revolution now taking place in the global logistic industry with innovative online solutions now being implemented throughout global supply chains resulting in more cost effective and efficient trade.

The presenters and panelists discussed the need for new technologies to meet the increasing complexities of exporting and importing with the challenging process of meeting the security, political and efficiency aspects between the exporter, importer and the government and private entities involved in the transaction while providing the necessary documents for compliance to consummate a transaction.

The conference highlighted new efforts from Customs and Border Patrol (CBP) and the Department of Homeland Security (DHS) to meet President Obama's directive to streamline the global trade process and for the U.S. to now take the lead to set the global standards for the implementation of the mandated 'single window' by the year 2020.

SINGLE WINDOW:

The new U.S. Single Window for the U.S. is called ACE (Automated Commercial Environment). ACE

will provide Importers and exporters the ability to submit all required information by means of a single,

electronic transmission with the relevant trade data being distributed to the appropriate federal agencies

for customs clearance and regulatory compliance purposes. ACE is managed by U.S. Customs

and Border Protection (CBP).

The conference also featured a project from TradePort.org for California to create a model for a seamless, integrated, responsive online system with global standards for import and export transactions of all sizes whether it's for multi-shipments across a global supply chain or just for a simple export or import transaction. The 'single window' through TradePort.org will provide a method for small and mid-sized enterprises (SMEs) to become more competitive in the global marketplace with effective and efficient logistic procedures while also giving them the capability to interact with multi-national supply chains as sub-contracting supplier.

MBITA/TradePort is now planning a follow-up conference in 2015 on the progress of these major changes in global logistics and the 'single window'.

Ayse's Corner

Ayse's Corner is a feature column of the World TradeWinds eZine'. Ayse Oge is a published author and global trade marketing expert and author of Emerging Markets.

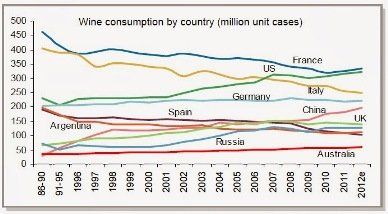

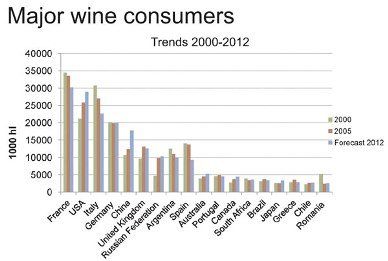

Some key trends in the wine industry are: Premiumization and Craft. This started with craft beer and has become popular among beer consumers and continued into craft spirits and more boutique artisan wines. The millennials who are coming into the age of alcohol consumption can be the best target market for these types of beer.

The U.S. industry created an initiative in 1998 called "WineVision" based on the opportunities presented by the global wine market to the U.S. vintners who are pouring their heart into the craft to be more competitive, both domestically and internationally.

WineVision focuses on three fundamental principles: 1) become the leader in sustainable practices and keep U.S. producers environmentally sound, socially responsible and economically viable, 2) make wine an integral part of the American culture, and 3) position U.S. wine as a high- quality, high-value product.

Expanding WineVision to provide educational and training workshops to help equip U.S. wineries with the business and export tools and skills they need to compete in the global marketplace would be a good strategy. This could help promote the valuable and sought-after California image in the developing world and allow U.S. wine producers tap into global consumers who want more of the good life.

MBITA's trade finance column features articles from the experts in the field of EXPORT FINANCING.

Thoughts on How to Price Open Account Export Sales

A competitor quoted $220,000, same list, 30 days open account payment terms.

To my chagrin, I lost the order. Why? The payment terms were more important to the buyer than price.

Going forward, I knew I had to offer open account payment terms if I was to be competitive. I could do this for small quotes that I could finance myself (i.e., "carry the Account Receivable (A/R) on my balance sheet"). But for large quotes that I could not carry on my balance sheet because I didn't have the capital to finance myself, I would have to reduce my margins even more to entice a buyer to buy from me on L/C terms.

To protect myself from the risk of non-payment on the small open account sales, I purchased an Eximbank export credit (non-payment) insurance policy. The policy covered 95% of my invoice value (including profit) on sales of product whose US content was 51% or more (calculated using the product's Cost-of-Goods-Sold (CGS) and exported from the US. The premium rate was $0.55 per $100.00 invoiced.

To compensate for the risk, cost and aggravation of open account terms, I added an additional 9% margin to my L/C price and quoted 30 days open account terms, "subject to credit approval".

If I won the order and Eximbank approved the buyer, off l shipped.

Worst case: if l had to file a claim, I lost my 5% co-insurance, my 0.55% premium paid and whatever interest carrying costs I might have had. Still ahead of the game.

Best case: if the buyer paid me 30-45 days after due date (typical in Mexico for a "good" buyer), I earned 9% on my money for a 90 day tum (30 days open account plus 45 days slow pay) times 4 turns a year= 36% annual return on my money.

If Eximbank did not approve the buyer's credit, I would tell the buyer that I could not get credit approval for this sale but I could offer him a "one-time-only" 10% discount if he paid me with an L/C or Cash in Advance (CIA). Back where I was to begin with (and the beneficiary of Eximbank's free advice).

Watch out that you do not "unbundle" the open account cost component of your price because your buyer will use it to negotiate a lower price from you.

For example, what if you quote Cash In Advance (CIA) or L/C payment terms and the buyer says "We like your price but we [Pepsi Cola, Pemex, whomever] never have and never will pay CIA for anything; payment terms must be 30 days open account"? Imagine the buyer's shock if you added (in my case) 9% to your CIA price for 30 day terms. He'd say "that's usurious! 108% p.a. ?"

You will have the same problem if you submit two quotes, one on CIA terms and the other on open account terms.

So, decide what your payment terms will be before you quote prices and stick to them. If a credit-worth buyer insists on open account terms, quote on that basis up to the amount you can support but do so without revealing the cost of your open account financing.

Margins will vary according to markets, but the principle is the same: open account payment terms are a legitimate "value-added" component to a sale that you should be compensated for.

John Keevan-Lynch is President of Provident Traders, Inc., a Northern California based export finance consultancy and licensed export credit insurance broker with more than 33 years experience with Ex-Im Bank.

Contact:

John Keevan-Lynch

President

Provident Traders, Inc.

Tel. (707) 895-9353

Email John Keevan-Lynch

Web: www.providenttraders.com

CONTRACT COVERAGE

When you're doing business directly with a foreign government, public-sector buyer, or government-owned entity, contract repudiation insurance can protect against non-payment of your invoices or non-honoring of your contracts, either before or after your shipment of goods or performance of services.

Coverage can also be written to indemnify against frustration of your contracts with private-sector entities that might be unable to perform due to expropriation, currency inconvertibility, political violence, or other local/international government actions or political events that would be out of your-or their-control.

If your business relies on licenses or permits issued by foreign governments, then you can obtain political risk insurance to cover against cancellation of import or export licenses or business permits, as well as embargoes, boycotts, sanctions, or decrees causing business interruption, payment defaults, or other losses.

ASSET PROTECTION

If your company has assets located abroad, you can insure them against expropriation, inconvertibility, and political violence-long-term or for the duration of a contract-in order to secure your own balance sheet and to facilitate arrangement of financing from your lenders or investors.

Expropriation insurance protects against confiscation, nationalization, and other foreign government actions or political events which would deprive you of your rights of ownership, security interests, or control of your assets situated in other countries. It also covers your ability to repatriate your assets, for example getting your equipment out of the country at the end of an operating lease or after completing a contract.

Inconvertibility policies cover your right to exchange local currency for US dollars or other hard currencies and protect against government prohibitions on transferring hard currency out of the country.

Political violence coverage insures against non-payment, business interruption, forced abandonment, or damage/destruction due to war, civil unrest, sabotage, or other government actions or political events.

MERIDIAN FINANCE GROUP brokers policies from every underwriter in the political risk insurance market, enabling us to quote the most competitive terms and premium rates. These policies work differently from other kinds of insurance, so Meridian provides comprehensive support to help our clients get the most out of their coverage. Contact: (310) 260-2130 or insurance@meridianfinance.com.

Statement of Fred P. Hochberg on the Release of Export Data from the Commerce Department U.S. Exports Reach A Record-High $198 Billion in July

Washington, D.C. - Ex-Im Bank Chairman and President Fred P. Hochberg issued the following statement with respect to July's record-high export data released today by the Bureau of Economic Analysis (BEA) of the U.S. Commerce Department. According to BEA, the United States exported $198.0 billion of goods and services in July 2014, the highest mark for any month ever recorded.

"These record-high numbers show that exports stamped 'Made in America' are sought out for their quality, reliability, and innovation," said Ex-Im Bank Chairman and President Fred P. Hochberg. "Given a level playing field, U.S. exporters can compete with anyone in the world, and Ex-Im Bank is proud to support American exports, just as they support jobs here at home."

Exports of goods and services over the last twelve months totaled $2.3 trillion, which is 46.6 percent above the level of exports in 2009, and have been growing at an annualized rate of 8.7 percent when compared to 2009.

This press release was issued on Sept. 4th by Ex-Im Bank. Press release source article.

Contact Office of Communications: (202) 565-3200.

##########

The National Export Strategy is available also at

http://trade.gov/NEI and http://export.gov.

International Trade Update at

http://www.trade.gov/publications/ita-newsletter/

United States Department of Commerce

Office of Public Affairs - Tel. 202-482-4883

##########

Must See Video on Global Trade

Click HERE to see the 'Making Hay' video by Dan Gardner of Trade Facilitators, Inc. This multi-industry webinar is a 'must see' for global trade students and practitioners of all levels and World TradeWinds considers it to be one of the most concise and informative webinars on the history, present state and the future of the Global Trade industry there is available today.

Sponsors, Partners, & Affiliates